Dateline: Woking, 26th September 2022.

The Reserve Bank of India (RBI) is creating a new set of arrangements to allow companies to settle foreign trade in rupees. This means that, to use an obvious example, Russian and Indian organisations can trade goods and services without using dollars. Under such arrangements Russian banks will be required to open rupee accounts with Indian banks and Indian banks will need rouble accounts in Russia. Both countries would have to agree to hold a sum, say $1 billion, in local currencies in their respective accounts. So, Russian banks will have rupees worth $1 billion in their Indian accounts and Indian banks will have roubles worth $1 billion in their Russian accounts. Indian exporters can then be paid in rupees for their Russian exports (from the rupees held by Russian banks in their Indian accounts) while Russians get paid in roubles for their Indian exports (from the roubles held by Indian banks in their Russian accounts). Once a mutually acceptable exchange rate determined by the market is decided upon, trade between India and Russia can proceed with no dollar legs.

But what is this exchange rate? Should it be determined with reference to the US dollar? Or would it be better to have some other reserve currency that is not dependent on the value of the dollar at all?

In June, President Putin (presumably stimulated by the international community’s response to Russia’s invasion of Ukraine) said that Brazil, Russia, India, China, and South Africa (the BRICS) are developing a new basket-based reserve currency. The presumption is that it will comprise real, roubles, rupees, renminbi and rand to present an alternative to the IMF’s Special Drawing Right (SDR). Much as Facebook’s doomed Libra project wanted to, the goal is to create a stable reserve currency that can be used to international commerce. In this case, the Brits Bucks (as I call it) reserve will be independent of the dollar completely.

Since India is importing large quantities of oil from Russia, for example, a mechanism to work out payments that are completely independent of the dollar is of great interest to both nations. Russia could price oil in Brics Bucks and obtain payment in roubles while India could price pharmaceuticals in Brics Bucks and obtain payments in rupees (although I note that Russian is not even in the top 10 of Indian export markets).

Will this have much of an impact? Not in the short term. ING analysts say that while it could be a "high-profile political statement" they doubt whether the trading nations in the BRICS sphere of influence would want to transfer valuable foreign exchange reserves, particularly dollars, into Brics Bucks and that if those nations are indeed responding to the weaponisation of the dollar, then they (like Russia) might prefer to move into gold.

It may be disappointing for the crypto fans out there, I didn’t see any mention of Bitcoin or any other cryptocurrency in any of the BRICS announcements. That’s not to say they may not play a role. The Russian news agency TASS recently reported that the Bank of Russia believe that in the “near future” it may be necessary to legalise cross-border payments using cryptocurrencies such as Bitcoin. So I can imagine good and services passing between the BRICS with the prices agreed in Brics Bucks and the payments taking place in Bitcoin.

The New New Gold

Does this mean that the idea of Bitcoin as digital gold for the new economy is back on the agenda? I don’t think so. Bitcoin is nowhere near being capable of replacing gold as a reserve. For one thing, the price can be manipulated too easily: Analysis of price movements in recent times shows that whenever Bitcoin’s price began to fall, Tether was issued by Bitfinex and sent to two other exchanges, where it was used to buy Bitcoin – which would then rise in price.

(Although as the recent conviction of JP Morgan traders shows, the price of gold can be subject to similar attacks. A federal jury in Chicago convicted Michael Nowak, the former head of JPMorgan’s global metals trading desk, and Gregg Smith, who worked as a trader and executive director in New York, of spoofing, wire fraud, commodities fraud and attempted price manipulation. The prosecutors had accused them of flooding the market with buy and sell orders — that represented half to three-quarters of the visible gold and silver markets at the time — that they never intended to execute, while trying to gain an edge over algorithmic traders.)

I think that tokenised commodities traded in regulated markets are an inevitability and make economic sense. But it won’t be only gold and oil and pork bellies and orange juice that is commoditised because the opportunities extend far beyond the physical assets that are commonly thought of as inflation hedges. Santander recently announced loans backed by tokenised soy and corn, with each token corresponding to a ton of grain that has been grown and verified by a proof of grain reserve (PoGR). This suggests that there is a new world around the corner where the tokenisation and trading of pretty much everything is an inevitability and this will have an impact in both traditional markets and in the decentralised, programmable, super smart autonomous giant killer robots markets that are coming.

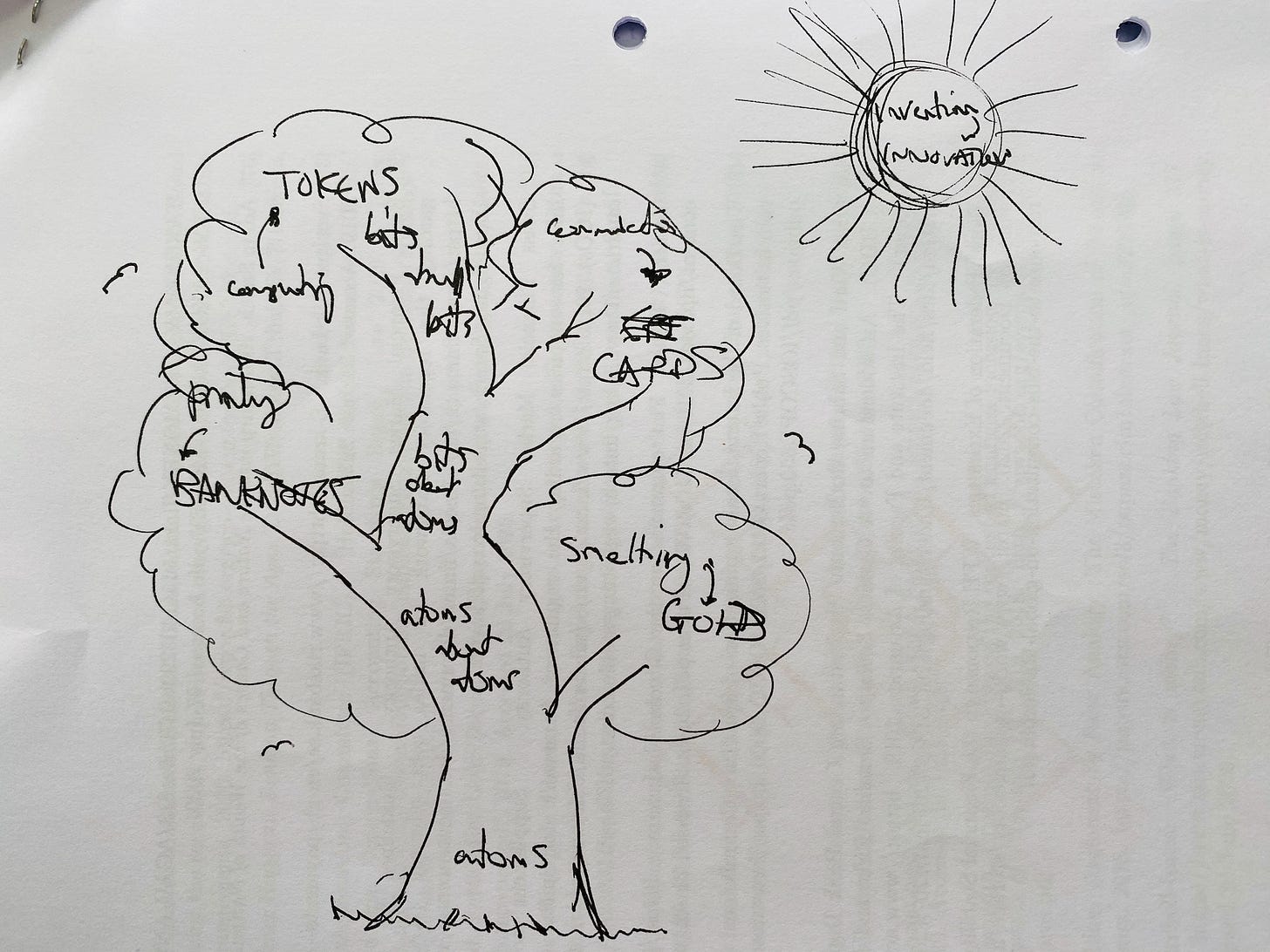

High level view.

Gold is the new Gold

Digital gold and Brics Bucks to one side, physical gold tokens are in the news too. The U.S. mint sold 426,500 ounces of gold in the first quarter of this year (up 3.5% year on year), their best gold sales for almost a quarter of a century, and Zimbabwe has just launched new gold coins to be sold to the public in a bid to tackle chronic hyperinflation. The coins can be converted to cash, traded and used for transactions according to the Reserve Bank of Zimbabwe but people can only trade the coins for cash after holding them for at least 180 days.)

(If you bought Canadian “Maple Leaf” gold coins instead of U.S. or Zimbabwean ones, you may be in for a shock as the German police busted a gang of scammers who have been selling fake ones with the face of Her Majesty Queen Elizabeth II on them.)

People out there are buying gold, for sure. According to my good friend (and gold bug) Dominic Frisby, in the past month the London market has seen a 44% increase in gold bought by doctors and 59% increase in gold bought by investment bankers. Quite what this means, I don’t know, but I do take it as evidence of a potential market for gold stablecoins, which is where I thought the ING observation was rather interesting.

Tokenised gold would seem to make for a decent stablecoin and, indeed, there a number of gold-pegged tokens on the market already. They are designed in a similar way to stablecoins, but rather than being backed by fiat they are backed by the value of physical gold held somewhere auditable. Those doctors, investment bankers and others might find it rather convenient to buy and trade gold tokens in wallets on their mobile phones.

(There are plenty of gold tokens already out there: Ranging from the Perth Mint token and Tether Gold through to Pax Gold and others.)

This tokenised gold may have an interesting trading advantage over the metal, which relates to provenance. Gold used to be fungible, but now it isn’t, because of Russia’s invasion of Ukraine. Immediately following Russia’s invasion, the London Bullion Market Association (LBMA), a trade body that sets market standards, removed all Russian refineries from its accredited list, meaning their newly minted bars could no longer trade in London or on the COMEX exchange in New York, the biggest gold futures trading venue. Britain's Royal Mint had Russian bars worth around $40 million in its ETF and got rid of them almost immediately after this.

The Bank of England, which has Britain's largest gold vault, said it considered Russian gold bars made before the invasion eligible to trade but gold produced after 8th March is not "London Good Delivery”. One might easily imagine gold tokens that represent metal mined and refined outside Russia beginning to trade at a premium over tokens that represent Russian gold!

(If investors remove Russian gold from their portfolios, the price could fall by anything from a dollar to $40 per ounce compared to non-Russian gold according to the industry sources quoted in that report.)

In Their Time

Would real digital gold (i.e., tokens backed by actual gold reserves rather than cryptocurrencies) be attractive in the longer term? I have absolutely no idea, but I was thinking about this recently when I listened to an episode of BBC Radio’s long-running series “In Our Time” on the topic of the Gold Standard. The host Melvyn Bragg and guests (Catherine Schenk, Professor of Economic and Social History at the University of Oxford; Helen Paul, Lecturer in Economics and Economic History at the University of Southampton; Matthias Morys Senior Lecturer in Economic History at the University of York) discussed the system that flourished from mid-Victorian times when gold became dominant and more widely available, following the gold rushes in America and Australia.

Interestingly, in the introduction to the radio discussion, Mr. Bragg said that the "golden century" was from 1870 to 1970. Mr. Frisby tells me it was from 1816 following the great recoinage and Britain returning to convertibility after the Napoleonic Wars up until to 1914 when Britain, France and Germany abandoned the Gold Standard to print money to pay for the Great War. I disagree with both of them, not that it matters, but in my book on the history and future of money Before Babylon, Beyond Bitcoin, I took a more technological view and dated the golden age from the invention of electronic money in 1871 (when money became bits about atoms) to Richard Nixon ending the convertibility of gold in 1971 (when money became just bits.)

(Charlie Crowson says that what is perhaps surprising is that the classical pre-1914 gold standard lasted as long as it did.)

Anyway, whatever the exact dates, under the Gold Standard, national currencies around the world were tied to gold and so to each other, meaning stable exchange rates. The idea began in Britain, where sterling was seen "as good as gold", and as other countries came on to the Gold Standard the confidence in their currencies grew, and the combination of stability and confidence led to a boom in trade and prosperity. There’s no need for a detailed history lesson, but the point is that Gold Standard lasted for a while then it finished. Without getting into the whole Wall Street vs. Main Street thing, it is not coming back whether based on physical gold or the digital kind.

Gold tokens yes, gold standard no.

P.S. In case you didn’t realise, the title is clever because Frank L. Baum’s “Wizard of Oz” is allegedly a commentary on the gold standard.

Are you looking for:

A speaker/moderator for your online or in person event?

Written content or contribution for your publication?

A trusted advisor for your company’s board?

Some comment on the latest digital financial services news/media?