China moves forward with CBDC

The first reports have appeared concerning the Digital Currency/Electronic Payment (DC/EP) system being tested in four cities: Shenzen, Chengdu, Suzhou and Xiong’an (the recently-established “development hub” near Beijing and it is where the “non-core” functions of the Chinese state are going to be relocated to). DC/EP is the Chinese implementation of a Central Bank Digital Currency (CBDC) and in my opinion at least it is a really interesting - landmark, in fact - development in the history of money.

with the kind permission of Matthew Graham @mattysino

The implementation follows the trajectory that I talk about in my book The Currency Cold War, with the digital currency being delivered to customers via commercial banks. The Deputy Governor of the People’s Bank of China, Fan Yifei, recently gave an interview to Central Banking magazine in which he expanded on the “two tier” approach to central bank digital currency (CBDC). His main points were that this approach, in which the central bank controls the digital currency but it is the commercial banks that distribute it, is that is allow "more effective exploitation of existing business resources, human resources and technologies” and that "a two-tier model could also boost the public’s acceptance of a CBDC”.

He went on to say that the circulation of the digital Yuan should be "based on ‘loosely coupled account links’ so that transactional reliance on accounts could be significantly reduced". What he means by this is that the currency can be transferred wallet-to-wallet without going through bank accounts. Why? Well, so that the electronic cash "could attain a similar function of currency to cash… The public could use it directly for various purchases, and it would prove conducive to the yuan’s circulation".

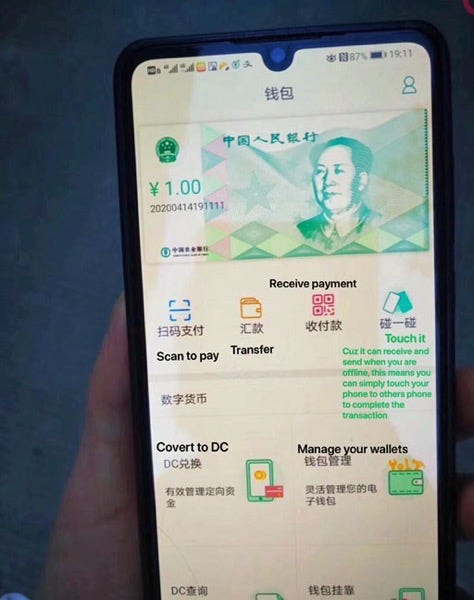

Hence what I thought most noticeable about the first implementations (this is from the Agricultural Bank of China, ABC) is that they do indeed in include this person-to-person offline transfer functionality. You can see the “touch it” button on the screen below.

(As I note in the book, this makes DC/EP look more like Mondex than Libra, so I was surprised to see the digital Yuan labelled “crypto-inspired” on Twitter!)

with the kind permission of Matthew Graham @mattysino

Anyway, my main point is that I agree with what is said here in this Fortune magazine article ”China is poised to beat the U.S. in the digital currency race” which that the shift to what I call "smart money" will reward first-mover economies. As this article notes, China will quickly integrate its digital currency into hundreds of "blockchain" projects in which autonomous digital sensors and devices directly exchange information and money. Removing intermediaries from these device-to-device transactions will allow China to automate entire Internet of Things (IoT) ecosystems, bringing efficiency gains to smart cities, supply chains, and electricity grids.

(This is, incidentally, why things will need digital identities just as people do.)

More importantly on the global stage, the Forbes article notes that China could offer digital currency machine-to-machine payments all the way along its the Belt and Road Initiative (BRI). Indeed it could. And will. The noted venture capitalist Fred Wilson supports this view, writing that the shift to digital currencies will be led by China "who moves first and benefits the most from this move”. He goes on to say that America will "hamstrung by regulatory restraints and will be slow to move” resulting ultimately in decentralised finance exchanges in Asia becoming the dominant capital markets. Whichever way you look at, digital currency is a big deal.