Smart Cities and Smart Currencies

Cities are prime candidates to create alternatives to national currencies.

Dateline: Woking, 3rd April 2022.

Last year I wrote that an economy that is a network of cities will demand different financial services and institutions from one based on national economies and I pointed to Jane Jacobs' seminal work on "Cities and the Wealth of Nations" from a generation back as well as more recent work, such as the Canvas8 report on "The city as an identity anchor" and the World Economic Forum (WEF) 2017 report that "Cities, not nation states, will determine our future survival".

Given this background, it's obvious why I have been interested in development in the decentralised finance world at the intersection of cities and cryptocurrencies. While cryptocurrency is forcing us to consider the relationship between money and the nation state (as I am fond of pointing out, a pretty recent arrangement) it seems to me the imminent nexus of cryptocurrencies and cities is a more interesting and potentially more radical stimulant for innovation.

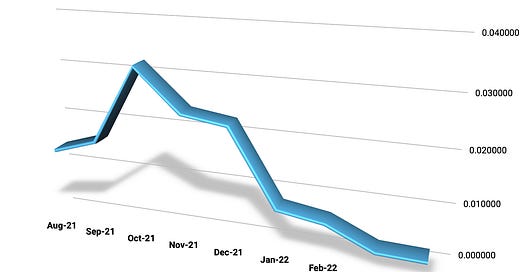

There have been some high profile experiments already. MiamiCoin (see chart below) is such an example, launched to some fanfare when Mayor Suarez tweeted: "Check out this on the first CityCoin being of course MiamiCoin!!!!!!!!!". MiamiCoin is implemented as a token running on Stacks, which is a smart contract platform built on top of the Bitcoin blockchain. Other cities, including New York and Philadelphia, are actively looking at the same or similar ideas.

The idea of these CityCoins is to allow users to mine coins for their favourite city while taking a cut and diverting funds to the city’s treasury. From one perspective, these initiatives are relatively uninteresting signalling rather than genuine experiments in alternative monetary structures. But they do reinforce the idea of the city as a currency community.

(It does seem odd that some of the same cities looking at cryptocoins are at the same time passing laws to force merchants to accept physical currency in compulsory tender. These are simultaneously anti-competitive backward-looking measures and a stealth tax on business, because if it was cheaper for businesses to accept cash, they would.)

If cities create cryptocurrencies as speculative instruments they are really only taking baby steps. On the other hand, if a city were to issue its own money and, for example, demand that taxes be paid in that money or that certain city services could only be paid for using that money, or the money was backed by some city assets or or other, that would be much more interesting.

While I have long been an advocate of this approach, please be reassured that I am not the only one. Last year, the Center for Urban Renewal issued a report “Re: New York City” that contained a number of ideas for renewal and economic growth. One of these came from the noted venture capitalist Fred Wilson (Founder of Union Square Ventures) who suggested that it might be time to create an NYC Coin, a local currency for the five boroughs that would keep money circulating within the community. As Fred pointed out, cities can use the technologies of cryptocurrency, digital wallets and contactless payments to implement such a currency with relative ease. While I am a strong supporter of New York Money (and New York Identity), I can see that this is still a big step for an existing city to take. Perhaps it makes sense to look to new spaces for this kind of experiment. Perhaps on an island somewhere?

Indeed, this is where certain utopians are already looking, having abandoned the idea of floating sea steads to sit beyond national waters. One such plan is to take a three million square metre island in the Vanuatu archipelago and transform it from undisturbed rainforest into a "sustainable smart city", filled with multi-storey apartment blocks and offices for cryptocurrency investors from around the world.

City Visions

Another approach is, rather than escape the nation-state, to create new cities within it. Private cities are already a thing. Although a recent phenomenon, Chinese “Contract Cities” (to pick one example) already house tens of millions of residents. They host a wide range of businesses and have attracted huge amounts of investment. They work because of cooperation between local government and companies who plan, build and operate the cities. The companies lease the land and obtain revenues from economic activity in the cities. The residents have management firms for housing and other services.

Coming from another direction, the rap music star Akon is about to begin building another crypto city in Africa. He already started planning a city in Senegal and is now planning a new one in Uganda. These cities (which use the "Akoin" cryptocurrency) fascinate me. I had the opportunity to ask Akon about the cities and he told me that his vision for them is as a “chance for the world to see the true potential of the people of Africa and inspire more Africans to join in”.

(He told me that his goal is to build not just one Akon City but many around the world, “creating hubs of African innovation and excellence”, which struck me as something considerably more valuable than cryptocurrency speculation. That’s not to say that cryptocurrency is not an important element of the vision, because he also told me that learning about the possibilities here was a “lightbulb moment”. He sees his cryptocurrency as the fuel that empowers and connects the people within the city to all they need within and beyond Africa.)

I also asked him, more specifically, how he intends his cities to improve the lives of their inhabitants and he said that he intends to place them in target locations so that they can be hubs, not only for tourism and business, but for education, health and entertainment. It’s an expansive vision and goes far beyond “simple” crypto-boosterism. When he told me that he wants to create modern smart cities in Africa, showing on the global stage what Africa can offer, I think he is illustrating a trend towards currencies that are more closely linked to the communities they serve.

There is no reason why cities cannot share the laudable goal of decentralised finance (which is to create a lower-cost, lower-friction, lower-entry barrier financial services infrastructure to better serve the wider economy) with nation states and create new forms of money that improve life for their citizens.

City Centres

When you think about how nation-states operate, there is actually a good economic argument for city currencies as well. Instead of London collecting tax money that is then sent via government transfer payments to the regions, I think we should at least explore the possibility of city-centric regions having their own money instead and allowing the free market to determine the relative values (from which capital flows will follow).

If this kind approach is adopted, then the “cash” of cities will become the most important kind to the average person. In other words, having abandoned Sterling for London Lolly and US Dollars for New York Notes and LA Loonies, these will be sufficient to provide the medium of exchange for future citizens. Right now, almost all transactions are local and even at the national level only 1%-2% of European transactions are cross border. If I live in London and use London Lolly for the train, for lunch and at the supermarket, is it such a big deal to convert it to Mumbai Moolah to buy something online? Especially when your phone does it for you and you don't even have to think about it.

So why don't we use these currencies already? Well, as a recent Bloomberg article discussing the renewed interest in complementary currencies noted, a key problem for them has been "finding a suitable way to cover operating costs". This is where, we think, there might be a crossing of streams at last. On the one hand, the pandemic means that a great many people are looking toward city-centric means of exchange as a specific kind of complementary currency that may contribute to rebuilding economies, and on the other hand the technologies of money have advanced considerably in recent years as the electronic money evolutionary tree has grown and flourished.

(Brixton bank notes might be pretty - so pretty that a David Bowie Brixton tenner sells for more than sixteen quid - but a Brixton app makes more sense, especially in the post-pandemic contact-free payments environment of the future.)

This is why I can’t help but return to the subject of the city as a currency community. The decentralising nature of the new technologies might well push us away from the fiat currency of the nation-state as the medium of exchange, but what will it push us towards? Will we decentralise down to the level of the individual? That seems unlikely. Will we decentralise into communities? That seems more likely. But which communities? Cities are the prime candidates.

Are you looking for:

A speaker/moderator for your online or in person event?

Written content or contribution for your publication?

A trusted advisor for your company’s board?

Some comment on the latest digital financial services news/media?