Programming bank accounts

I’ve been reading an interesting paper from Northumbria University called "Recipes from Programmable Money". The paper looks at what customers of the UK challenger bank Monzo have done with its integration with IFTTT (the "if this, then that" automation software) to draw some early lessons that may have wide applicability to post-PSD2 financial services infrastructure. This is fascinating to me (even though I think the title is wrong, because it's not the money that is being programmed but the bank accounts) because it is natural to wonder what, once third-parties are free to build on banks’ interfaces because of PSD2, customers will want from the new product and service providers.

The paper goes about examining how real users (albeit savvy early adopters in the UK) used the ability to automate a selection of Monzo account actions. Since these automations are a small window into what users might want from from more general third-party API-based interactions, I think the researchers have uncovered useful insights about just how important XS2A will be. After all the speculation about what API access to accounts might mean for Europe’s banks, there’s no substitute for looking at what consumers actually do with the new technology.

It seems to me that the key finding of the paper is that "some of the most intriguing recipes in our corpus were those that integrated Monzo with applications that ordinarily have little to do with banking". (“Recipes” are the IFTTT automation scripts.) That is, in general, consumers use banking services as integral to other services, which is what you might expect on reflection because users don’t want to do banking, which is boring, they want to do other more interesting things that happen to be facilitated by banking.

The authors also observe that "this proliferation of financial data across different platforms, and channels, highlights the way in which programmable money may cut across services" and that "we are seeing how money and transactions are potentially just another form of data, to be pushed and pulled around integrated services". I am sure they are correct about this, which is why it will be so hard for banks to find effective strategies to compete with other providers of those integrated services. It may well be that only the lower margin “‘pipe” services are available to them, in which case they need to focus on operational efficiency to compete.

All very interesting, and wholly congruent with earlier analyses from informed industry observers (eg, me). But it’s another point made in the "programmable money” paper that caught my eye. It’s impossible to disagree with it when it concludes that technologies such as machine learning, AI and smart contracts "foreground the delegation of significant financial power to automated systems and agents”. As I wrote last year, in the context of competition in retail banking, the future choice of banking services provider (the AS-PSP, in the euro-jargon) will be made not by customers, but by bots. It seems to me that the early indications from the real world are that this is correct, and that it has many ramifications.

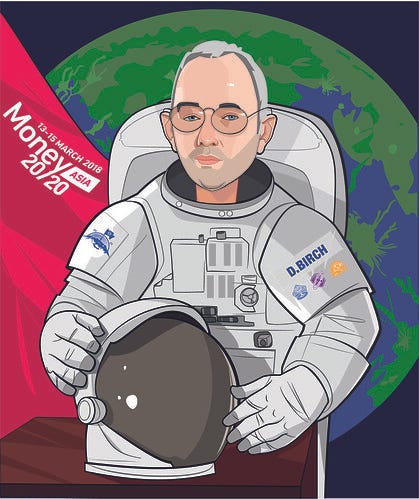

I’ll give you an example. If you live in the UK and are over the age of around 30, you may have seen an advertisement with a man in a spacesuit in it.

No, not that one. I mean an advert on TV, the sort of thing that no-one under 30 ever sees any more. It’s an advert for a bank. It doesn’t matter which one. The point is that it’s about brand and image. But what will be the point of it a world where an AI-powered child-of-IFTTT is doing the heavy lifting? Consumers may neither know nor care who their bank is. This will pose a challenge to those with a career in marketing, but it may have some positives too. For example, I can assure Barclaycard that my bot will pay no attention whatsoever to their advertisement with Simon Cowell in it, whereas like most normal people I would cancel my card because of it.

My bot will chose your bank on the basis of interest rates, response times, jurisdiction, functionality, service uptimes and other such measurable parameters. Your logo? Your sponsorships? Your history? Whatever.