Factories or supermarkets: post-pandemic banking

As we move into the inter-pandemic period, there is an interesting discussion to be had about whether the changes induced by the COVID-19 crisis are short- or long-term and to what extent those changes are an acceleration of existing trends (as I think they are, largely) or new directions for the sector. Ron Shevlin wrote an excellent piece in Forbes highlighting one element of strategic change, saying that "the new normal marks the end of fintech experimentation”. He went on to point out, somewhat harshly, that banks have used fintech partnerships as a way of convincing themselves that they are innovating rather than actually doing anything transformational.

I completely agree. I gave some seminars to bank management on the impact of technology on the business a couple of years ago, and to set up a narrative to help the executives frame my approach, I said that I thought the “fintech era” would run through to 2020 when it would be overtaken as the shared paradigm. My prediction, which I stand by, is that we are leaving the fintech era and entering the open banking era. The virus may have accelerated the transition between the eras, but it was coming anyway.

In the open banking era, fintechs will not vanish, but they will innovate and operate in a different way. They will not need to partner with incumbents, since they can use open banking infrastructure to get access to their customers’ data that the banks have, and their costs to market should be reduced through the use of standard interfaces. This means that the fintechs will be able to focus on the customer journey and user experience to bring new products and services into the market.

So what, then, should the banks focus on? At this year’s (sadly virtual) Paris Fintech Forum I hosted an interesting discussion with Simon Paris, the CEO of Finastra. Simon rather kindly reminded me of my predictions about what we now call open banking in the Centre for the Study of Financial Innovation (CSFI) report on “The Internet and Financial Services” back in 1997.

(As an aside, I remember that when the CSFI held a twenty year reunion to discuss this seminal report, it was interesting to see just how much of the report was spot on about the impact of the internet but I was spectacularly wrong about one particular point: I thought that digital TV as well as mobile would become a commerce channel. What actually happened, of course, was that the mobile became a permanent second stream for commerce.)

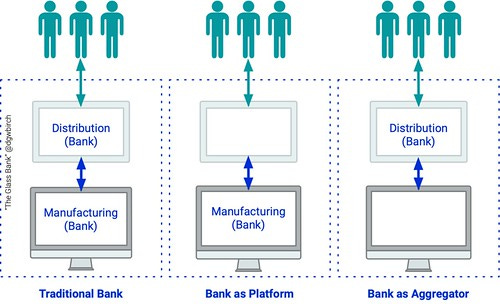

Anyway, Simon and I were discussing the split between the manufacturing and distribution of financial service, so I thought it might be useful to post my short and high-level recap of the strategies available to banks across this split.

Factory Reset

The techfins are the technology companies who embed financial services to make their own products more attractive but whose business model does not depend on margin in those financial services (as that Economist article noted "Amazon wants payments in-house so users never leave its app”.). The fintechs are companies who embed technology to make their own products more attractive and whose business model depends on margin in those financial services such as one of my favourite companies, Wise).

The techfins (as opposed to the fintechs) are more than happy to have banks, for example, do the boring, expensive and risky work with all of the compliance headaches that come with it. What Big Tech wants is the distribution side of the business, as shown in this old diagram of mine. They have no legacy infrastructure (eg, branches) so their costs are lower and the provision of financial services will keep customers within their low-cost ecosystems. If you use the Google checking account and Google pay then Google will have a very accurate picture of your finances. A very accurate picture indeed.

The business model here is very clear. What Big Tech wants isn’t your money (the margins on payments are going down) but your data and just as Big Tech has made ecosystems impervious to competition, so it could cross-subsidise (with data as well as with money) its financial services products to raise such a barrier to competition that no newcomer will be able to spend enough to gain traction. Hence the evolution of bank-as-a-platform for other financial services organisations to bank-as-a-service (BaaS) that Simon and I were discussing: it will be non-financial distributors who get the products into the hands of the people. Kids opening their Next bank accounts will neither know nor care that the actual account is provided by Barclays.

That’s why I have bored audience senseless repeatedly telling them that when people talk about “challengers”, they should be talking about Microsoft and Nike not Monzo and N16. If Big Tech takes over consumer relationships, banks will end up having to give away margin but, far more seriously and far more unrecoverably, data. As Andrei Brasoveanu of Accel said, if Big Tech gets hold of the distribution side of the financial services business, then the manufacturers of financial services products will be "utilities, providing low-margin financial plumbing". Well, that’s the lucky ones. The unlucky ones will be wiped out in a wave of manufacturing supply-chain consolidation and factory closures.

[This is an edited version of an article that was first published on Forbes, 26th June 2020.]

Are you looking for:

A speaker/moderator for your online or in person event?

Written content or contribution for your publication?

A trusted advisor for your company’s board?

Some comment on the latest digital financial services news/media?