Peak Credit Card

Dateline: Woking, 19th November 2021.

The opening shots have been fired and the war for consumer payments has begun. Well, the phoney war at least. The opposing armies are jockeying for position. Amazon’s opening bombardment of the card scheme’s trenches began this week when they announced that they will stop accepting Visa credit cards issued in the UK from 19 January, 2022. This prompted a variety of online discussions about Brexit and cross-border interchange, the bundling of credit with retail payment mechanisms, merchant service charges and co-brands, all of which were fascinating. But I couldn’t help but think that this is just one front on a wider war against credit cards being fought by PSD2, BNPL, instant payments and (who knows) maybe even digital currency in the future.

The global credit card players will undoubtedly be following this spat with great interest. After all, as many people have observed, Visa and Mastercard in particular have impressive margins (EBITDA of 60-70%) that might indicate some sort of market failure. With a new spectrum of possibilities opening up in a world where all banks are connected to all retailer and all consumers all of the time, the 1960s four-party party may be over. One specific possibility is open banking. And, in particular, open banking in the UK.

Open Alternatives

Here in the UK, the Treasury has been undertaking a Payments Landscape Review that sets out some high level aims for the sector and has published its response to the consultations. These include a call to unlock open banking-enabled payments safely and securely to allow consumers to pay for goods and services both in store and online directly from accounts. Many observers expect that this will provide an alternative to credit and debit cards, creating competition for the existing infrastructure and players to give consumers and businesses more choice between payment mechanisms. It will also (and personally I am more interested in this agenda) create new opportunities for fintechs to build a new generation of payment products (i.e., rather than attempting to emulate 70 year-old card products that combine authentication, authorisation, credit, convenience, cash replacement and so on in a single bundle).

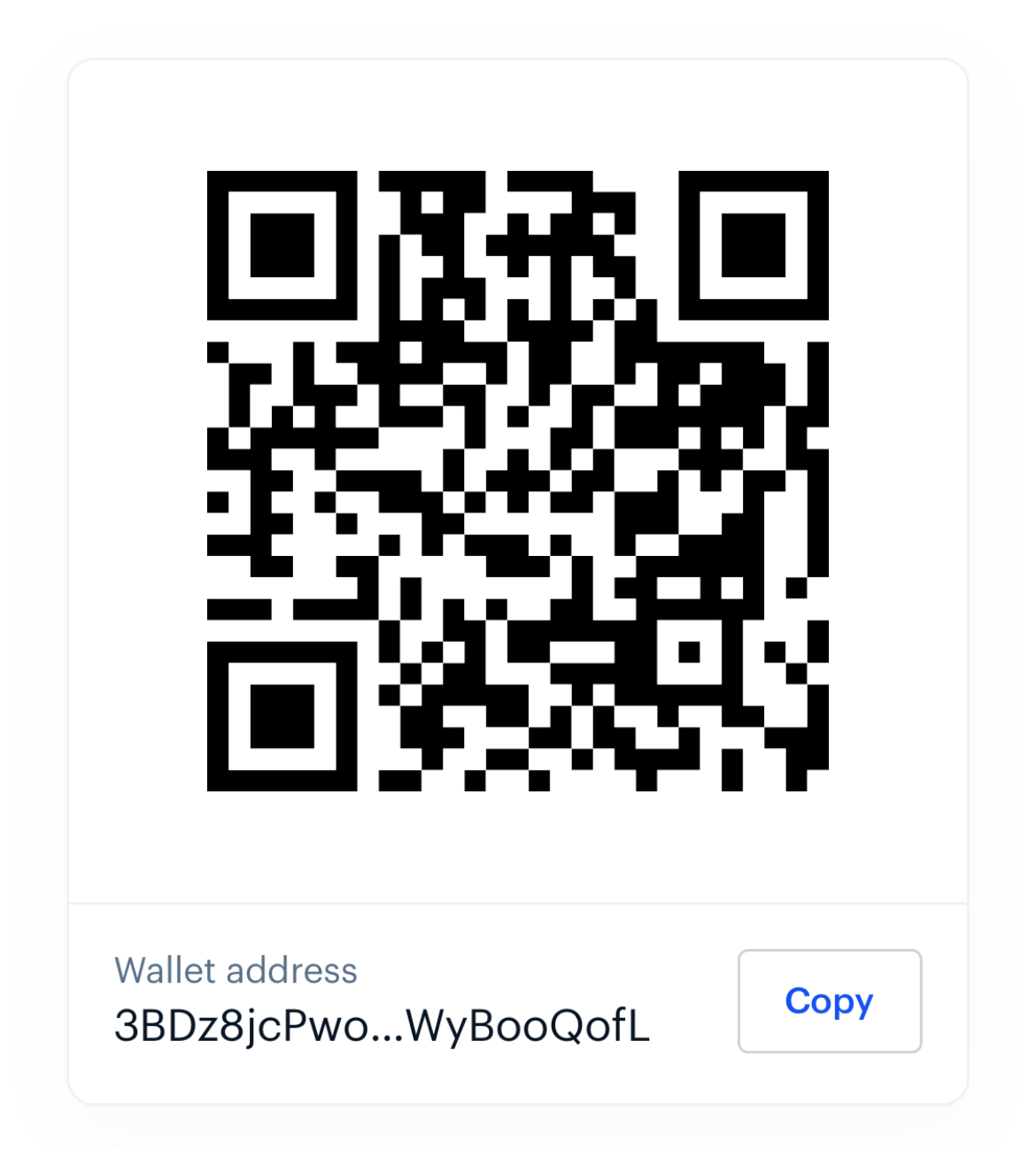

I'm not smart enough to know exactly what these products will be, but I can see that retailers and others are looking to develop and evolve their apps and wallet products and that account-based payments can find a home with them. Rita Liu, formerly of Alipay and now of Mode (and someone with a deep understanding of payment innovation), links open banking and QR codes by saying that "QR codes can revolutionise the front end as they have in the East, while Open Banking can revolutionise the back end". This is a characteristically accurate analysis of the opportunities for bringing added value to merchants. As she highlights, the direct flow of information between consumers and merchants creates a simplified, cost-effective value chain, and it can transform merchants' relationships with their customers by leveraging data to offer a truly personalised experience.

This is precisely what Australia's domestic debit network Eftpos hope to achieve with their launch of the eQR service. It has signed up Commonwealth Bank, National Australia Bank, Azupay, Beem It and Merchant Warrior to support the rollout of the new platform. It also has the biggest retailers on board, Coles and Woolworths, As with other retailers, one of the attractions for such chains is that their app can combine payments, loyalty and spend tracking in one so that for consumers a simple quick QR scan is all that is needed to complete their checkout.

The account-to-account (A2A) back end for these new propositions is coming together and it was interesting to see that Plaid is making a move into this space with a set of strong payment partners in North America and Europe - including Square, Dwolla and Currencycloud (recently acquired by Visa) - that will integrate Plaid into their processing systems for payments direct from bank accounts. This means we will soon see "pay from your bank account" options being presented by merchants, billers and wallets.

(Since apps are a good way to satisfy security requirements and initiate instant payments, I can well imagine my Amazon app sprouting this new feature fairly soon. Order something on the Amazon web site, the app pops up on the phone and asks for £23.45 or whatever - the consumer authenticates with a fingerprint and the money is pushed from their bank account to Amazon’s in a nanosecond.)

Retailers will begin by presenting A2A payments alongside conventional payment card options such as credit or debit cards. I can imagine, however, that many organisations will start tender steering toward this lower cost, more secure option: It won't be long before merchants are offering double points or free Prime movies or whatever to encourage consumers to send money directly from their bank account to the merchant's bank account.

I think the emergence of A2A alternatives to cards is an important evolution in retail payments. Driving down the cost of payments and reducing the margins available across the value chain is a good thing. Here's one reason why: credit cards are not a perfect payment mechanism. Card fraud aside, Joanna Stavins (senior economist and policy adviser at the Federal Reserve Bank of Boston) is the co-author of a recent paper that looked at the cost of credit card rewards and, as she notes, central to the dynamics of their use is that consumers who use credit cards "tend to be cross-subsidized by consumers who use cash or debit cards".

This is true in the UK as well. The government banned credit and debit card surcharges back in 2018, which was great news for me because now I can use my premium cashback rewards card everywhere. Until January 2018, when I had used my premium card to book a flight, I had to pay a credit card surcharge. I didn't mind paying the surcharge because I wanted the protections that the use of credit cards give me as a consumer and also because I wanted the frequent flier points I get for using this card. Now I get all this stuff for free, and less well off people who can't afford the annual fee for the premium card are subsidising my free flights to all points of the compass.

Schemes

With growing interest in A2A, are we then at peak credit card? With mobile wallet transactions overtaking cards worldwide, clearly the incumbents themselves think that open banking is a way forward in developed markets. To give the obvious examples, Mastercard spent $825m on Finicity and Visa bought Sweden’s Tink for nearly €2 billion (in Europe, Tink provide a single API for customers to access aggregated financial data, initiate payments, enrich transactions and build personal finance management tools). Soon after Mastercard bought their Danish competitor Aiia.

We are beginning to see serious new propositions emerge. To go back to my airline example, Emirates was the first airline to go live with the IATA/Deutsche Bank "IATAPay". This enables real-time payments from customers who book tickets through the airline website, with money transferred directly to the carrier without the intervention of third parties. It charges a fixed fee of a few cents per ticket. The target (for Emirates and other airlines) is credit cards. (Right now around two-thirds of their tickets are paid for by credit card, while the remainder is cleared through country-specific payment options.)

Here's an example of the kind of proposition this drives: kevin. This is a Lithuanian payments startup that just secured $10 million in new capital in a seed funding round co-led by OTB Ventures and Speedinvest, two of Europe's leading venture capital investors in early-stage European technology companies. The round also included OpenOcean and Javier Perez's Global PayTech Ventures. Their point-of-sale product enables customers to pay from their bank accounts through existing card terminals using NFC technology. Tadas Tamosiunas, CEO and co-founder claims that up to 40% of their customers' transactions are being made directly open banking via mobile apps and when it comes to online payments it's more than 70%. They already have 2,700 merchants in 15 markets, including Sweden, Finland, Norway, Poland, Netherlands and Portugal so clearly merchants are open to alternatives to payments based on card rails.

There’s another great proposition live in the UK, by the way, and I use it regularly: payments to the government for employer and employee taxes. Her Majesty’s Revenue and Customs (HMRC) use Ecospend, a London-based open banking provider, so that when I log in to pay tax I can (and always do) choose to pay directly from the bank: At which point I am redirected to log in via internet banking and confirm the transaction before being returned to the HMRC. It’s simple, safe and convenient.

It’s Time

I am hardly the only person looking in this direction to see the next generation of payments coming together. The new CapGemini World Payments Report says that A2A transactions enabled through open banking are a “pressure point” on bank payment strategies and according to McKinsey, instant payments are playing an “increasingly important role” in the global payments ecosystem, with transactions up by 41 percent last year alone (often in support of contactless/wallets and e-commerce). PwC call attention to what they call the parallel trends of evolution in the payment systems (e.g., instant payments and digital wallets) and structural change in the payments ecosystems (cryptocurrencies and central bank digital currencies).

Given these widely-recognised dynamics I am surprised it took so long for A2A initiatives to accelerate, but investors are now piling in. Look at the recent rounds for Volt (a $23m series A), Trilo (£1m pre-seed) and Banked ($12m to date) as well as the growth of Sweden’s Trustly (which recently delayed a billion dollar IPO).

Whatever the Treasury says, open banking payments here in the UK are set to get another boost because of what is known as Variable Recurring Payments (VRPs). Due to general bank hopelessness, this has been delayed until mid year, but when it arrives VRP will allow customers to safely connect authorised third parties to their bank account so that they can make payments on the customer's behalf (within agreed parameters). Mike Kelly, who was the product lead for VRP, says that they have "huge potential to revolutionise finance" and he is absolutely correct.

Right now, if I want to allow a supermarket to push money from my account to their account (via their wallet app, for example) then I have to authorise each transaction individually. Doing this through some sort of request-to-payment mechanism is a very good solution in many circumstances (e.g., HMRC now and then or a monthly subscription payment to a gym that keeps trying to charge you even though you cancelled months ago) but it's not a good solution when you are standing at the checkout in the same supermarket that you have shopped at twice a week for the last decade. In that case, granting the supermarket VRP rights to push payments from your account after (e.g.) scanning a QR code at the checkout makes for a much better experience.

With major players such as Plaid pushing forward the ecosystem, it won't be long before the decade-old dreams of MCX (the failed multi-retailer attempt to oust the networks a few years ago) are a reality and your supermarket QR-driven wallet will first give you the option of paying from your bank instead of via a credit or debit debit rails and then pretty quickly moves to put this option at the top of the list and offers you double points for paying that way.

People who say that credit cards work just fine are just plain wrong, but it seems to me that open banking rather than cryptocurrency will provide a better retail payment system in the near term.

Are you looking for:

A speaker/moderator for your online or in person event?

Written content or contribution for your publication?

A trusted advisor for your company’s board?

Some comment on the latest digital financial services news/media?

Great read! Just missed one name of an old Dutch A2A scheme ...