Open Banking? We Need Open Everything!

JP Morgan Chase’s charges for API access focus the mind.

Dateline: Paris, 24th September 2025.

The not entirely unexpected news that JP Morgan Chase intends to start charging for customers’ data that is obtained by third parties through APIs, data that is provided free through “open banking“ in other parts of the world, caused significant comment across the fintech sector. The not entirely unexpected news that Plaid have agreed to pay these fees has implications across the fintech sector.

Open Banking Needs A Business Model

JPMC’s charges affect how fintech platforms access information through intermediaries, particularly data aggregators (such as Plaid). who provide the infrastructure layer that sits between banks and third parties. You can see their point: JPMC say that of the almost two billion monthly API requests that they process, only a small fraction come from customers. Most API calls come from fintech who want the customer data for their own purposes, including improving their products and marketing.

As Jason Mikula pointed out, if these aggregators are forced to begin paying banks on a per data access basis, those costs will inevitably be passed along to aggregators’ fintech customers, and, presumably, those fintechs’ end users. This may make some of the services unviable, which will in turn reshape the market in a couple of ways:

Fintechs will close down because they can’t make money providing services, so the banks will step in to provide those services that the fintechs have discovered to be viable, thus keeping all of the margin to themselves, and

Fintechs will focus their efforts on finding a way around bank rails, perhaps looking to alternative infrastructure around wallets rather than bank accounts and digital assets and digital identity (including digital identity for AI agents) to deliver innovative services. As industry guru Tom Noyes pointed out at the time of the announcement, it provides the economic incentive for alternative models, “like stablecoins and DeFi”.

Banks, in general, have always been against this kind of data sharing because they see the data as theirs, rather than the customers, and argue that since they have put the effort into collecting this data, securing it and maintaining its integrity, they should be entitled to earn something from it because (Noyes again) banks have invested heavily in creating secure APIs and have every right to price their attestation services, just as consumers have the right to access their data.

For the economy as a whole to benefit we therefore need to find a compromise that would allow the banks to earn a reasonable return on the data but also benefit the wider economy. In other jurisdictions, that compromise takes the essential form of “basic and “premium“ services., which seems a reasonable way of working, so my high-level view is that there should be a standard model put in place to encourage the use of bank data for the greater good while providing balanced rewards. Using the language of cards, this means resolving interchange and liability. In other words, who gets paid what when things work properly and who compensates whom when things go wrong.

It seems to me that it should hardly be beyond the bounds of human ingenuity to find appropriate solutions. For example, the regulators might decide that the banks will earn zero interchange on basic facts about the account holder but they can earn whatever interchange they set for other premium services that they want to provide (an example might be giving a “safe to spend“ limit for the purposes of regulated gambling). In return for fees, the banks will also have to accept liability.

I would need to defer to someone like Tom Brown, but I would’ve thought it might be possible to construct a solution that is based on transactional but not contingent liabilities. In other words if I give you a loan because I think you have an account with a certain amount of money in it and it later turns out that it wasn’t you then the bank should be liable to the value of the loan but not beyond it.

with kind permission of Helen Holmes (CC-BY-ND 4.0)

Open Banking, Open Data

There is, however, another aspect beyond such “interchange fees” where I do actually feel the banks have a reasonable complaint and that is symmetry. The banks argue with complete justification that open banking does not create a level playing field for competition if they are required by law to provide basic customer data for nothing whereas third parties are not. They would argue that if they have to provide customer data to a social media company, for example, then the social media company should provide social graph data to the bank.

(This is an argument that’s been raging for years in Europe and the example of the Consumer Data Right in Australia shows one way forward here.)

Taking all of this together, I think the principle of banks being allowed to charge something for customer data is sound, provided it is within a framework set by the regulators to maximise the net welfare and not to maximise the profits of commercial banks. The fact is that allowing customer data to flow, under an equitable arrangement, is good not only for banks and fintechs but for society as a whole.

Open Banking Needs Open Minds

This is not only about open banking data. There is another, bigger picture here. In a paper on “The Data Economy: Market Size and Global Trade” for the Economic Statistics Centre of Excellence (part of the UK’s National Institute of Economic and Social Research), Diane Coyle and Wendy Li wrote about the “data gap” between global Big Tech and potential competitors, disruptors and innovators. They argue (convincingly) that this data gap is a a barrier to entry that affects not only businesses but also aggregate innovation, investment and trade. Similarly, the European Council on Foreign Relations (ECFR, a prominent think tank) published a call for action on “Defending Europe’s Economic Sovereignty” in which it called for the EU (and the UK) not to put up barriers at all but to agree data free-flow with the US.

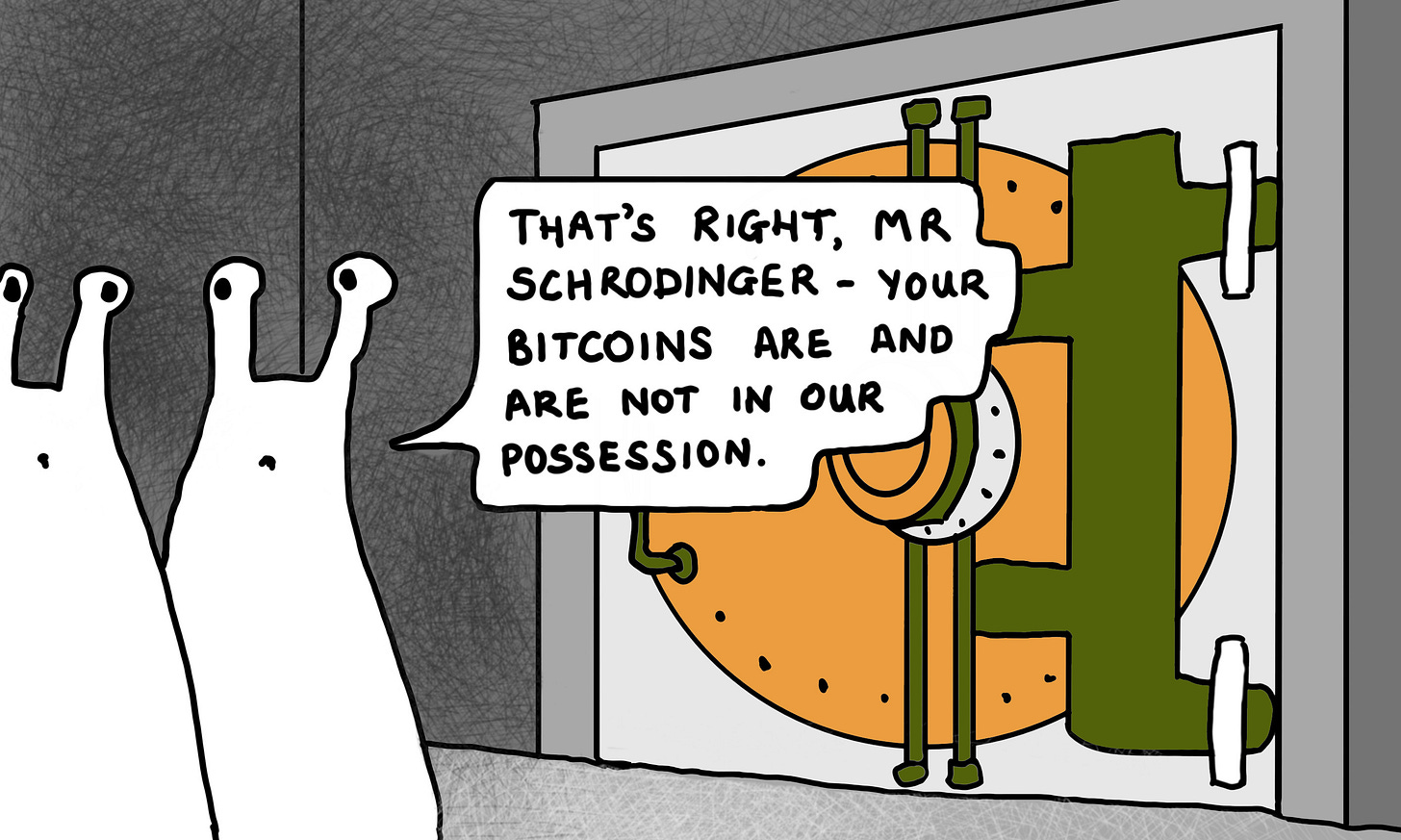

Coule and Li conclude that an open data-sharing ecosystem will increase productivity and therefore economic wellbeing. From my inexpert perspective, I could not agree more, and I note that this debate is now opening up again because of the US GENIUS Act. The Act allows Big Tech (and others) to acquire nonbank stablecoin issuers and use those issuers’ funds to establish dominant market positions. Many observers are concerned about allowing BigTech to issue and distribute stablecoins if it would give those firms access to their customers’ private financial data.

All of which means that if I were the CEO of a US bank, I might be tempted to play a longer game. I would go to the industry and say something like ...

“It’s not fair that we have to share data with people who don’t pay for it. It costs us money to build and maintain the APIs. However, it will also cost us money to build a billing platform and provide customer support for that, and those costs will have to be passed on too.

However, we are responsible members of society and we want society as a whole to benefit from economic growth. We know it is better for economic growth if data flows rather than being hoarded, and we want to do our part to help the data flow safely and securely.

So here’s the deal: we will provide basic customer data free of change, but only to organisations who provide their basic customer data free of charge. If a mobile company wants to use our customers’ data for free, they must let us use their customers’ data for free.

I believe in capitalism and competition but on a level playing field. In other words, forget about open banking and open everything. I know this sounds radical, but I hope that US regulators will, in time, choose this path, a path that grows the pie while ensuring that everyone, including banks, gets a fair slice.

Are you looking for:

A speaker/moderator for your online or in person event?

Written content or contribution for your publication?

A trusted advisor for your company’s board?

Some comment on the latest digital financial services news/media?

https://openmoney.org/ - an idea for the time?