I Thought We Were An Anarcho-Syndicalist Cryptocommune

A DAO Is More Exciting As An Idea Than As A Reality

There is an odd aspect to the charge towards web3 and decentralisation and the missionary zeal to reform financial infrastructure, which is the reinvention of things that didn't work in the past in the hope that "this time it will be different". An interesting example comes form the world of sports, where an enterprise called WAGMI United is apparently planning to purchase a British soccer team using cryptocurrency.

The WAGMI United backers (which include include Gary Vaynerchuk, the President of the Philadelphia 76ers, Tiger Global and Slow Ventures) are looking at decentralised ownership, which could lead to a decentralised autonomous organization, or DAO, in the future.

(Update: WAGMI have announced the takeover of Crawley Town FC.)

Now, in case you have recently awoken from a persistent vegetative state, I should remind you that a DAO is a blockchain-based form of organisation that is often governed by a native crypto token. Ownership of these tokens means the ability to vote on the policies of the DAO. DAOs use "smart" "contracts" (ie, apps that can, and often do, go wrong because of software) to manage this process and to-coordinate efforts and resources. I rather like Jonah Erlich's formulation (he is a member of ConstitutionDAO, which tried to buy one of the original copies of the US Constitution at auction): a DAO is a "group chat with a bank account".

So what this means for sports is the use of ownership tokens for decision-making by clubs, which sounds fascinating and a real opportunity for fans to get involved and there are other DAOs active in the space, such as Links DAO which plans to buy a golf course and the Krause Hause DAO which plans to buy a basketball team.

Who Wants To Be In Charge?

Perhaps it is time for a lesson from history because, as it happens, we already had a proto-DAO soccer club here in England. It is called Ebbsfleet United and its role in the historic evolution of soccer DAOs began back in 2008, when it made the national news because it was taken over by an online community. The experiment began well, as the club won the FA Trophy (a national knock-out competition for minor league teams) just months after the takeover, beating Torquay United 1-0 in front of more than 40,000 people in the national stadium at Wembley. They finished the season midway in their league and the manager, Liam Daish, was able to use the investment to retain players he could not have afforded to without MyFootballClub's investment.

The fan voting evolved in what I imagine many social anthropologists would regard as an entirely predictable way. After the investment, the fans voted on who should pick the team, themselves or the manager: they chose the manager every time. This is exactly what I would do: If I had a vote in how Manchester City should line up at the weekend, I would inevitably delegate that vote to someone who knows what they are doing (in this case, one of the most successful managers in the history of the game, Pep Guardiola). Why on earth would I allow people like me to decide on something that they have no demonstrable aptitude for?

(And please spare me the “wisdom of crowds” nonsense that has been rendered irrelevant by the advent of social media.)

Will Brooks, who was behind the idea in the first place, later said that "one of my biggest conclusions is that perhaps the idea was more exciting than the reality". I think this is probably going to be true of any other DAO as well. Even if there was a wisdom of crowds to be tapped, people have other things to do. Such communities tend to evolve rapidly into groups where a small number of people co-ordinate action and the majority are happy to delegate responsibility. You get, in effect, cabals or councils who direct the organisation. Thus there is what SEC Commissioner Hester Peirce called “shadow centralisation”.

In the end, the club went not for shadow centralisation but for actual centralisation as the members voted in favour of handing two thirds of their shares to a trust and the other third to one of the club's major shareholders (run by a group of Kuwaiti investors). As I write, they sit third in the National League South (the sixth tier of English soccer).

I can’t help but feel this is a shame, but there you go. As John Naughton says, there is “something touching about the DAO idea”. In a weird way it embodies 1960s idealism, communes and kibbutzes, and the idea of more democratic structures to overthrow the prevailing hierarchies. John’s view is that those experiments failed because alpha males and egalitarianism did not mix then and will not mix in the future (although out in the cyburbs, alpha status derives not from your gender but from the size of your token hoard).

All of which leads me to reflect on whether people actually really do want DAOs or not? Richard Brown, CTO of enterprise shared ledger company R3 explored this from a very informed perspective recently. As he pointed out, that true decentralisation will create a parallel financial system, where AML, KYC and CTF rules are not applied. A system where no investor protection rules apply. A system where no accredited investor rules are in force. Whether you think this is a good idea or not, Richard is right to observe that this is not a new environment, but the very environment that we used to have, but don't any more. Or, to put it another way, if the Wild West was all that we'd still be living in it.

Web 2.5

It is interesting to note the DAOs are actually exploring the new Wild West already. In Wyoming, DAOs have been buying land albeit as a "proof of concept" to experiment with what it means to own real estate on a distributed ledger. One of the people behind the experiments, Max Gravitt (a member of the Kitchen Lands DAO), calls this form of ownership "highly liquid and global". It allows him to transfer tokenised shares of the land easily, although it is some way from a libertarian revolution since the actual physical land that the DAOs own is still restricted by laws and permits and so forth. When asked where this is going, one of the other DAO owners said "Nobody really knows. Like, it's just a lot of good faith right now".

(It is possible that the commentator has never actually met anyone in real estate, and I don't want to be that guy, but I'm not sure that good faith is actually the bedrock on which that sector of economy rests. Although to be fair, in a rating of selected U.S. professions in terms of honesty and ethical standards, real-estate agents did score more highly than members of congress and auto salespeople.)

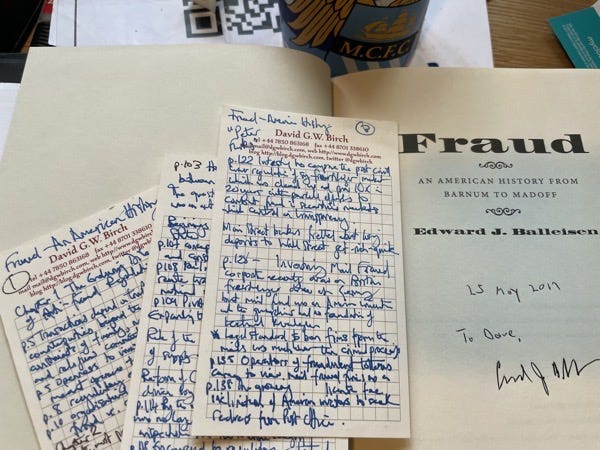

This reminds me to mention one of my very favourite books: Professor Edward J. Balleisen's "Fraud: An American History from Barnum to Madoff". (By the way, I recorded a discussion with Professor Balleisen about his book a few years ago, you can listen to it here on Soundcloud.) The book magisterially describes the evolution of regulation and institutions to protect consumers and investors from the Gilded Age onwards. Reading this, I couldn't help but see the world of web3 and the proto-metaverse as being similar to America in the age of the railroad barons. Being your own bank and we-don't-need-no-stinkin' badges sounds great, until your grandma clicks on the wrong link in an e-mail suddenly her house belongs to some guy in Minsk who flips it in three nanoseconds.

The idea of a more efficient financial system that is based on trading tokens across translucent ledgers is actually rather appealing since, as many people have observed, the cost of financial intermediation is a tax on the economy and directs resources away from more productive uses that we need to maintain our standard of living and economic growth. But that does not mean no regulation and no institutions: truly decentralised systems just do not survive, they mutate into centralised systems (i.e., representation and republic) or an anonymous oligarchy (whales and warlords). I don't know what to call the combination of defi technology and cefi governance, but for now I'll call it web 2.5 and see if it sticks.

Are you looking for:

A speaker/moderator for your online or in person event?

Written content or contribution for your publication?

A trusted advisor for your company’s board?

Some comment on the latest digital financial services news/media?