Legal and illegal tender

But so what if a digital dollar become legal tender? The physical dollar is legal tender in the U.S. right now and plenty of retailers won't take it.

China is home to not one but two fascinating experiments in what people have taken to calling “stablecoins". One of them is the public electronic cash system run by the People’s Bank of China (PBOC), known as the Digital Currency/Electronic Payment (DC/EP) or the digital Yuan. The other is the private electronic cash system run by Hong Kong-based Tether Limited, the cryptocurrency stablecoin known as the Tether. The main use case for the former is currently retail purchases whereas the main use of the latter appears to be market manipulation and money-laundering.

We can learn a lot from studying the dynamics of these to help us to understand how the world of digital currency might develop and whether cryptocurrency might one day become legal tender.

Let’s have a look at illegal tender first. In 2019, USDT surpassed Bitcoin as the most-traded cryptocurrency on the market by volume. This is not, as you might imagine, because consumers prefer to USDT to Visa for ordering a taxi to take mother to church on a Sunday. As reported by Nikkei Asia, USDT is widely used in money laundering, gambling and other illegal activities. China’s Ministry of Public Security has reported that in the first nine months of 2020, police cracked down on 1,700 online gambling platforms and 1,400 underground banks involving more than $153 billion in illegal transactions. Now, not all of this was in Tether, of course. But the number did catch my eye, because I am always interested in use cases for cryptocurrency other the speculation.

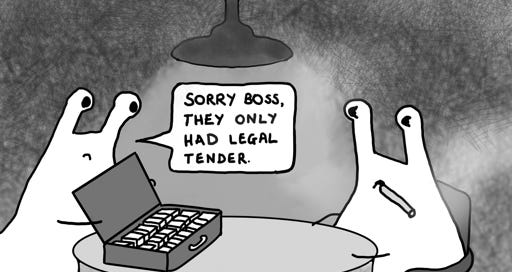

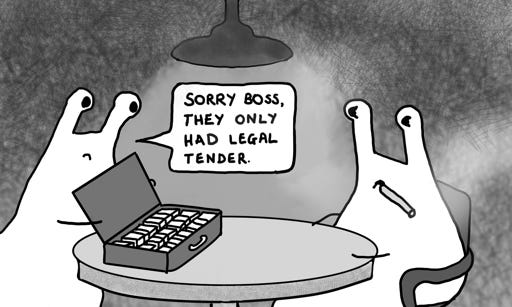

with kind permission of TheOfficeMuse (CC-BY-ND 4.0)

Now on to legal tender. Suzhou has long been spearheading trials of DC/EP and in a recent experiment the local municipal government gave away 100,000 digital "red packets", each containing RMB 200 (around $30) in a lottery, to encourage resident and retailers to try out the electronic cash for themselves. The South China Morning Post reports on the roll-out of the digital Yuan with the example of "shopkeeper Ma” who said that he found the digital currency to be a convenient way to receive and make payments. Not that it matters whether he finds it convenient or not, to be fair, because according to an “operational guidance” document given to the retailers in the pilot programme, they are allowed to decline payment in Alipay or WeChat Pay, but they "cannot decline payment in e-yuan”. You can see the trajectory.

The PBOC published a revised draft of the People’s Bank of China Law in October, laying out the legal foundations for the e-Yuan. The law, in essence, already says that the e-Yuan has the same legal status as the Yuan. Indeed, last year the PBoC issued a formal notice clarifying that cash is legal tender in China and that refusing it is illegal. More recently, it has called for wider acceptance of cash in economic activities and "vowed to punish" those who refuse to accept cash payments. So in China, both the Yuan and e-Yuan will be legal compulsory tender and retailers will have to accept both.

Legal Tender

I remember a story about a schoolboy who was refused access to a bus in Wales for trying to pay with a Scottish banknote. The bus company was pressured and apologised, saying that “Scottish currency is legal tender”. Actually, it isn’t. Scottish banknotes are not legal tender in England or, for that matter, Wales any more than Bitcoins or e-Yuan are. Only Bank of England banknotes are legal tender in England and Wales. But there are Sterling banknotes printed by banks in Scotland and in Northern Ireland that are not.

Scottish banknotes are not legal tender anywhere, even in Scotland. In fact, Bank of England banknotes are not legal tender in Scotland either, because Scotland has a separate legal system to England and has no legal tender law at all. This quaint monetary arrangement might seem odd to Americans, but it helps me to make a point: In America as in Britain, legal tender does not mean what you think it means.

I wrote about this in some detail after someone on Twitter told me that Bitcoin was legal tender in Germany. It isn’t, of course. In fact, Bitcoin isn’t legal tender anywhere* and it never will be any more than British Airways frequent flier miles will be (and I’ve bought more cups of coffee with British Airways frequent flier miles than I’ve ever bought with Bitcoin).

Let’s dive in! Section 31 U.S.C. 5103 on “Legal tender” states that “United States coins and currency [including Federal reserve notes and circulating notes of Federal reserve banks and national banks] are legal tender for all debts, public charges, taxes, and dues”.

Here is chapter and verse from The Fed commenting on what that means: “This statute means that all United States money as identified above is a valid and legal offer of payment for debts when tendered to a creditor. There is, however, no Federal statute mandating that a private business, a person, or an organization must accept currency or coins as payment for goods or services. Private businesses are free to develop their own policies on whether to accept cash unless there is a state law which says otherwise”.

So… would a U.S. central bank digital currency (e$, for short) might become legal tender in the future. Here, I think the answer is unequivocal: yes, and in unlimited amounts, because there is no credit risk attached. I predict that a transfer of e$ will be considered legal tender all debts, public charges, taxes and dues. In time, Section 31 U.S.C. 5013 will undoubtedly be extended to say so.

There is no federal law that forces people to accept dollars as it is, which is why you see municipalities passing local ordinances to force retailers to accept cash. (These ordinances are, by the way, a bad idea but that's a story for another day.) Would the U.S. amend legal tender law to go as far as China and force merchants to accept a CBDC? I doubt it. Would the Fed declare any digital currency that meets regulatory approval to be legal tender and retailers will have to accept both physical dollars and digital dollars? It seems unlikely. Would the US accept CBDC for the payment of tax? Actually, that day might not be so far away, as far I as am concerned what is or isn’t accepted for the payment of taxes is a much better measure of what is or isn’t a currency than outdated concepts of legal tender!

*Addendum (2024): Bitcoin is now compulsory tender in El Salvador, of course.

~

Are you looking for:

A speaker/moderator for your online or in person event?

Written content or contribution for your publication?

A trusted advisor for your company’s board?

Some comment on the latest digital financial services news/media?