Dateline: Lisbon, 18th June 2024.

I’ve been reading Geoff White’s new book “Rinsed”, which is all about money laundering. In the book he tells the story of a gang of money launderers based in Bury, in the north of England (they were all caught: the gang leader got 18 years the chokey and the gang members went down for between 11 and 15 years). Once the police had some of their Bitcoin addresses, the blockchain delivered an immutable record of where their money came from and went to. Which left me wondering what I should do to if I were to come across a stash of bent bitcoins.

Property Rights and Wrongs

Do you remember the classic scene in the cult movie Office Space where the characters are trying to work out how to launder money and so they bring in a guy that they assume to be a drug dealer? He turns out to be a computer programmer who knows nothing about money laundering at all.

That was in the 1990s. How would they go about money laundering now? They would probably use Bitcoin. This would be a big mistake, because one of the reasons why Bitcoin is not money, but property, is that it is not fungible. Coins that are stolen can be tracked using the immutable public record of transactions, the blockchain.

In the case of the bitcoins stolen from the hacked cryptocurrency exchange Bitfinex, they were followed for years and anyone who is interested in technology and money cannot fail to have been fascinated by the story of the New York couple found guilty of that hack and ordered to forfeit the proceeds from the nearly 120,000 bitcoins they laundered. The couple, the wannabe rap star “Razzlekhan” and her computer programmer husband, are surely going to be the subject of a Netflix movie, or even series, in the very near future!

(Zeke Faux rather memorably described Razzlekhan as both “hypersexual and aggressively unappealing”.)

I don’t know how I would go about laundering $4.5 billion in stolen cryptocurrency but I’d probably feed it out to hundreds of wallets, convert these into currencies such as Monero, trade them for Tether and then back into Ethereum and use some mixers to obfuscate the source. I’d convert back and cash out the Tether wallets across different exchanges in random amounts below $10,000 and then feed the proceeds into offshore bank accounts. Then I’d set up half a dozen companies and use them to issue invoices for consulting services and pull the offshore money onshore. Or something like that.

All good options to consider. Here’s what I wouldn’t do though: Buy a $500 Walmart gift card and give my real name and the address of my Wall Street apartment, which is what Razzlekhan did. It turns out that she is even worse at money laundering than she is at rapping.

Property Wrongs

What would I buy instead of a gift card then? Maybe I would buy a Ferrari. They accept payment in cryptocurrency for their cars in the US and are extending the scheme to Europe following requests from what their marketing people refer to as “wealthy customers”. I don’t know if you are allowed to buy Ferraris in cash without giving a name and address though.

Maybe I could send the proceeds to Switzerland? I think in the old days there were no questions asked there, but unfortunately I see that Switzerland intends to "tighten obligations" for Swiss lawyers, accountants and other service providers. This will require them to conduct due diligence on clients, keep records of the checks, and report suspected instances of money laundering to official authorities. Let’s hope that the Swiss lawyers adopt the same stringent measures as in the UK, where the now ex-Russian warlord Yevgeny Prigozhin passed lawyer’s money laundering checks with his mother’s gas bill.)

No, I think I’d look closer to home. The Law Society of England & Wales says that money laundering through property is "a major problem, especially in London”, although I note with interest that Forex Suggest's crypto real estate report shows that the UK is only eighth on the list of countries where real estate is currently listed as available for crypto purchasing. Still, the UK is relaxed about foreign ownership of trophy assets and London has oodles of luxury property, an ideal repository for large bundles of cash in need of washing. Lawyers, bankers and other professionals offer what The Economist refers to as a "reassuringly discreet, and expensive, service”. So their first appointment should have been with a North London real estate broker to buy a nice mansion in a leafy neighbourhood.

with kind permission of Helen Holmes (CC-BY-ND 4.0)

Once the mansion is secured, there are plenty of ways to move on, and ComplyAdvantage have some helpful suggestions on their website. The couple could have rented out a property, renovated the property with expensive fixtures and fittings and then re-sold it. They could also have benefitted from the property's appreciation over time (and anyway the price of real estate is easy to manipulate). Realtors, developers, mortgage brokers and other have sometimes been found to turn a blind eye to real estate money laundering in return for a slice of the proceeds.

(The manipulation of real estate prices is easy enough, but the opportunity for money laundering via anonymously transacted virtual goods will I am sure overtake it in the future. Who can say what the price of a virtual piece of Malibu is worth? The top 10 virtual land deals average over $2 million each, I would be surprised to find that there was much in the way of oversight as to the fair market value.)

A nice house in North London can be rented out for a fair whack of what then appears to be clean money so that sounds good. And it can be used as collateral for a clean loan that can used to buy an Aston Martin. To illustrate just how widespread this sort of thing is, note that Transparency International found that £1.5bn of UK property was bought by Russians who had been accused of corruption and/or sanctioned! They also found that more than 2,000 companies registered in the UK and its overseas territories were from Russian money laundering and corruption cases. Together, these cases involved more than £82 billion worth of funds disguised by rigged procurement, embezzlement, and bribery.

(The EU will soon have a new Anti-Money Laundering Authority, AMLA, to monitor illicit financial flows. The agency’s location is the about to be selected by the European Council and the European parliament, but obviously it won’t be London.)

Property Professionals

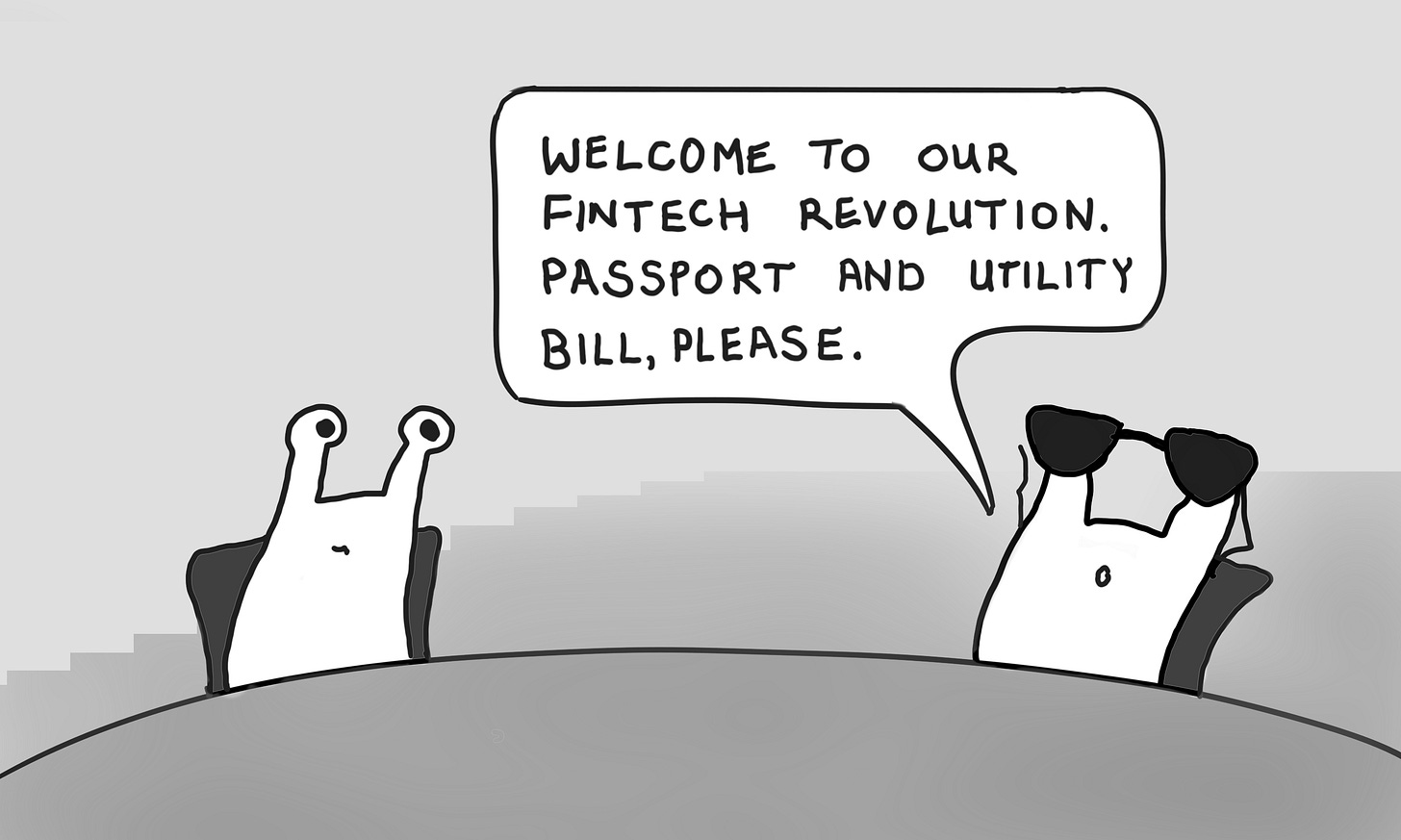

Chainalysis’ fascinating 2023 report on Crypto Money Laundering says that "illicit addresses” were sent nearly $24 billion worth in cryptocurrency last year, an increase of more than two-thirds on the year before. Mainstream centralised exchanges were the biggest recipients, taking in just under half of all funds sent from illicit addresses. As Chainalysis point out, that is interesting because those exchanges (fiat off-ramps, where the illicit cryptocurrency can be converted into cash) generally have compliance measures in place.

So is it Monero then or a casino on a riverboat? Create a chain of cash-only restaurants or go into ZCash? Shell corporations trading intellectual property or offshore corporations trading Tethers? Buy some NFTs and sell them at an inflated price to sock puppets? I’m still not sure and there are no fintechs yet offering me money-laundering-as-a-service.

There are a few simple precautions I would take though. For example, when the Feds knock on my door, I’ll make sure that my collection of burner phones used to manage cryptocurrency wallets is not in my kitchen in a bag labelled “burner phones”. Pro tip.

Are you looking for:

A speaker/moderator for your online or in person event?

Written content or contribution for your publication?

A trusted advisor for your company’s board?

Some comment on the latest digital financial services news/media?

After losing $1 million in a crypto scam, I was devastated. I didn’t think recovery was possible until I reached out to BitReclaim.com. Their forensic experts traced the stolen funds to leveraged outsourced wallets and helped me recover a significant amount. I’ve already detached the first part into my Trust Wallet and am waiting for the gas fees to finalize the recovery. BitReclaim.com saved me from financial disaster.

Email: bitreclaims@protonmail/com

Phone: +1 310-893-5756

Telegram: @bitreclaims

Love this article David. It reminds us that although money laundering is not without risks there are many people who will help or turn a blind eye.