Dateline: Castlebridge, 23rd November 2024.

Across the five countries covered in a global study carried out for Google — Brazil, France, Germany, the U.K. and the U.S., — most consumers say they are familiar with the digital wallets in their pockets or purses. In the U.S., for example, 85% say they know about digital wallets. However the research shows that consumer views about digital wallets are often confused. In the sample only 1 in 10 consumers were able to distinguish digital wallets from other types of platforms, such as digital banking apps, and this confusion highlights an interesting disconnect between the technologies consumers are using and their understanding of them. All of which suggests some education is needed in order for both the providers of digital wallets and their users if the full potential is to be realised.

Digital Wallets Are Here

So what is the difference between an app and a wallet then? I asked ChatGPT, so you don’t have to, and it told me that an app is a broad category of software designed for various tasks whereas a wallet is a specialised type of app specifically focused on storing payment methods and (and I rather like this perspective) facilitating electronic transactions. This seems like a reasonable way to structure a discussion, but there is another way to summarise the difference: whereas: an app is a way to do things, a wallet is a way to organise things.

What things? Well, my Apple Wallet (just like my real wallet) is cash-free. It has credit cards, debit cards, loyalty cards, vaccination records, boarding passes, train tickets and soon my driving licence and passport as well. This is not only about the Apple Wallet, of course.

The Google Wallet app now has an “everything else” option that can convert any physical document, card or whatever else into a digital pass. This functionality, announced in May, initially for Google Pixel devices uses the device camera to automatically detect compatible information (such as a barcode) and import it into the wallet using (of course) AI to detect the document type.

Google is also beta testing ID for use at some American airports by using Google Wallet to scan the security chip in a US passport (with the now traditional selfie video to verify identity and liveness, of course) and the company says that they are already exploring new applications with partners (e.g., account recovery, identity verification and even car rentals).

Note that the credit cards, the movie tickets, the passport and the loyalty cards and everything else are all held independently in the wallet: they do not talk to each other and they do not share data with each other. And crucially, they are all about identity, not money.

It is important to understand why this is so important. Digital wallets are not just for replacing cash; they are also becoming a repository and an organising principle for credentials. This observation fleshes out a strategic definition of the wallet: as a way to organise the credentials that are needed to enable transactions.

Ultimately then, wallets are about organising identity, not money. If you think that competition around digital wallets is only about selecting cards to make payments, you are seriously missing the big picture.

Robot Wars

Now we know what wallets are, let us look at their impact. Worldpay’s Global Payments Report 2024 suggests that innovation in retail payments is being accelerated because the ubiquitous acceptance of digital wallets enables greater consumer choice and control. According to their research, digital wallets accounted for $14 trillion in the global transaction value in 2023, representing half of all online consumer spending and almost a third of consumer spending in physical locations. In the UK, the transition to digital wallets is well underway. Almost half of us Brits aged 16 and over do not take their wallets with them when leaving the house, relying solely on their digital wallets as a payment method.

While digital wallets are gaining traction for their features beyond making purchases, for now transactions remain the most common use of the technology. The Google study found that almost half of consumers said they would likely use digital wallets to carry out financial transactions in the next year, while around a quarter said that they would use the technology for age or identity verification; to access rewards, discounts or coupons; for event tickets; and to store financial documents or information.

TL:DR; “Top of wallet” is so last century.

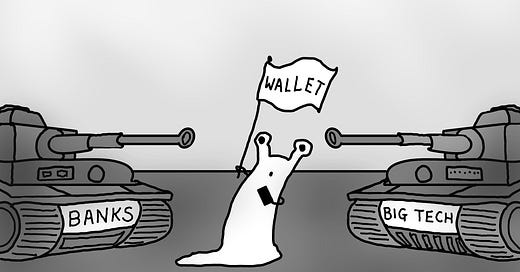

with kind permission of Helen Holmes (CC-BY-ND 4.0)

The fact that wallets are about much more than payments explains why the “wallet wars” are under way. Right now, in the UK and the USA, big tech has its tanks on the banks’ lawn, so to speak, and are encroaching on financial institutions’ territory with digital wallets in the vanguard and financial products (e.g., savings accounts) ready to invade and occupy.

Banks and other financial firms are mounting a counterattack with their own apps, fighting for a the prize of billions of dollars in fees and other revenue as digital transactions grow from $9 trillion in 2023 to an estimated $16 trillion over the next five years, according to Juniper Research.

The role of big tech is central, which is why in the UK the Financial Conduct Authority and Payments Systems Regulator are undertaking a consultation because they also want to know about the role of digital wallets and how they could impact competition between payment systems - and whether they could raise any significant competition, consumer protection or market integrity issues.

If you are anywhere in the payments value chain, you need a wallet strategy.

Going Smarter

Good. Now we have that useful definition, we can push the discussion further by asking whether the future belongs to the evolution of apps into super apps, or wallets into smart wallets? My biases are clear: I am a smart wallet kind of guy. In fact, I think we are indeed heading into a world of very smart wallets. By this I mean wallets with interfaces to associated intelligent agents to take care of transactions that are too boring (e.g., paying for car parking) or too baffling (e.g., deciding whether to put spare money into a tax-efficient cash savings account or one based on equities) for most of us to deal with.

What is particularly exciting in that the very smart wallet view of the future is that the users of the smart wallets will, in the general case, be bots. This is something that strategists need to take on board, a point I made earlier this year when I spoke at the excellent “Banking Scene” conference in Brussels.

(I always enjoy this event by the way, because it gives me a view of developments in the European banking world from the ground floor.)

I spoke about the shift from smart wallets (wallets controlled by people) to smarter wallets (wallets controlled by bots) and what this might mean in the world of payments and the strategic need to make wallets attractive to machines. My conclusion was, I think, uncontroversial: not only are the wallet wars hotting up, they are going to force us on to some pretty interesting new battlegrounds!

Are you looking for:

A speaker/moderator for your online or in person event?

Written content or contribution for your publication?

A trusted advisor for your company’s board?

Some comment on the latest digital financial services news/media?