China and America both need new fintech regulation

In a recent episode of Professor Scott Galloway’s podcast, he talked with one of my favourite writers: the eminent historian and Hoover Institution senior fellow Niall Ferguson. The subject of the conversation was the relationship between the United States and China. Their fascinating and informative discussion ranged across many fields, including financial services and fintech. Ferguson touched on a particular aspect of what he calls “Cold War 2” in context of finance, saying that American regulators “have allowed the fintech revolution to happen everywhere else” by which I think he meant that the nature of financial regulation in America has been to preserve the status quo and allow the promulgation of entrenched interests while the costs of financial intermediation have not be reduced by competition. He went on to say that "China has established an important lead in, for example, payments”, clearly referring to the dominance of mobile payments in China and the role of (in particular) Alipay in bringing financial services. He made this comment around the same time that the Chinese government pulled the plug on the Alipay IPO, what would have been the biggest IPO in history.

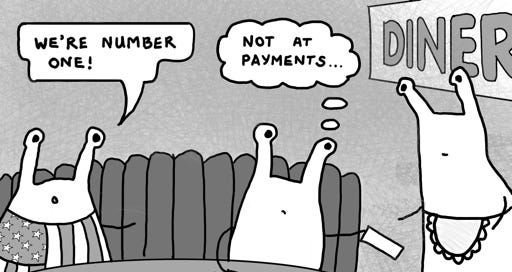

with kind permission of TheOfficeMuse (CC-BY-ND 4.0)

As an aside, if you want to understand some of the big picture around the coronavirus, currency (and what I call "The Currency Cold War” in my book of the same name), then you might want listen to this Coindesk podcast with Ferguson and the journalist and author Michael Casey. They talk about the current state of the world and what it could mean for money. As the author of one of the best books on the history of finance, The Ascent of Money, Ferguson has a very wide and well-informed perspective on the issues and, indeed I quote him more than once in my book! [bctt tweet="At a time when America is finally beginning to at least think about opening up financial services to allow real competition, China is heading in the opposite direction by clamping down on fintechs." username=""] Ferguson’s point about payments is particularly interesting to me. One way to provide more fintech competition to the incumbents would be to provide a more relaxed environment for payments. America lacks a regulatory construct equivalent to the EU’s “Payment Institution” and it really needs one if it is to move forward. The EU regulatory framework has just been battle-tested with the collapse of Wirecard following massive fraud. No customer funds were lost in the collapse of the badly-regulated non-bank because the customer funds were ring fenced in well-regulated bank and, as I will suggest later, this might be the right regulatory balance for new US regulation. One place to look for this new regulation might be the OCC, which has developed the concept of the Special Purpose National Bank (SPNB) charter. I don't want to sidetrack into the controversy around these charters, except to note that the OCC expects a fintech company with such a charter to comply with capital and other requirements that seem unlikely to generate the innovation and competition that America wants. This was obvious from the comments on the original proposals, when fintechs made it clear they would be reluctant to invest in such an OCC license unless such a licence would require the Federal Reserve to give them access to the payments system (so they will not have to depend on banks to intermediate and route money for them). The fees associated with such intermediation are significant (ie, top five) operating cost for many fintechs. I agree wholehearted with Prof. Dan Lawry of Cornell Law School, Lev Menard of Columbia Law School and James McAndrews of Wharton Financial Institutions Center who in their response to the OCC’s proposal labelled it "fundamentally flawed” and called for the organisation to instead look at strengthening the regime for non-bank financial institutions. The focus on banking regulation, though, seems entrenched. I notice that Congresswoman Rashida Tlaib (MI-13), along with Congressmen Jesús “Chuy” García (IL-04) and Chairman of Task Force on Financial Technology Rep. Stephen Lynch (MA-08), have just introduced the Stablecoin Tethering and Bank Licensing Enforcement (STABLE) Act, which similarly propagates this outdated (and inappropriate) regulatory perspective by requiring any prospective issuer of a “stablecoin” (let’s not even get into what is or is not a stablecoin) to obtain a banking charter. There is an alternative. The idea of another kind of federal charter that would allow regulated institutions access to payment systems, but would not allow them to provide credit, seems much more appealing for not only stablecoin issuers but almost all other fintechs as well. Such a charter would separate the systemically risky provision of credit from the less risky provision of payment services, a very different concept to the SPNB charter. The economist George Selgin, Senior Fellow and Director of the Cato Institute's Center for Monetary and Financial Alternatives, recently posted a similar point on Twitter, arguing for the Federal Reserve to give fintechs direct access to payment systems (instead of having to go through banks). This was the approach taken in the UK when the Bank of England decided to give settlement accounts to fintechs, where examples of fintechs who took advantage of this opportunity to deliver a better and cheaper service to customers range from the $5 billion+ Transferwise money transfer business to the open banking startup Modulr (which just recieved a $9 million investment from PayPal Ventures). Interestingly, Singapore has just announced that it will go this way as well, so that non-banks that are licenced as payment institutions will be allowed access to the instant payment infrastructure from February 2021. My good friend Chris Skinner was right to say that many US fintechs will follow the likes of Varo, apply for new licenses and become more and more like traditional banks, but that’s because the traditional bank licence is all that is on offer to them. But this is an accident of history that jumbles together money creation, deposit taking and payments. It’s time to disentangle them and to stop, as Jack Ma (the billionaire behind Alibaba and Ant Group) recently said, regulating airports the way we regulate train stations. He said this was shortly before Chinese regulators halted Mr. Ma's IPO, following his comments questioning financial regulation, clearly signalling that their relaxed attitude toward the growth of China's financial giants is coming to an end. The Chinese regulatory environment is changing. Whereas China was happy to see its techfins grow in order to help them scale while American enterprises were kept at bay, it is now beginning to rein them in. The new players are now having to build up capital and review business structures as those regulators focus on issues such as data privacy, banking partnerships and lending. With respect to that latter point, note that the concerns around the Alipay IPO were related to lending and leverage, not payments. Although heading towards half of Ant’s revenues came from the lending, facilitated by their vast quantities of data, but they only came up with 2% themselves (if they were were a bank, they would be required to provide something like a third) passing the rest of the exposure onto banks. Meanwhile, in September, the European Commission (EC) adopted an expansive new "Digital Finance Package” to improve the competitiveness of the fintech sector while ensuring financial stability. The proposed framework includes a legislative approach to the general issue of crypto-assets, called Markets in Crypto-assets (MiCA). I’ll spare you the whole 168 pages, but note that it introduces the concept of crypto-asset service providers (CASPs) and defines stablecoins as being either "asset-referenced tokens” that refer to money, commodities or crypto-assets (although how this can be called “stable”, I am not at all clear) or “e-money tokens” that refer to one single fiat currency only. E-money tokens (eg, Diem) are a good way to bring innovation to financial services because they are a way to bring genuine competition. I think the EU may be charting a reasonable course here. China needs to regulate lending more, the US needs to regulate payments less. America needs more competition in the core of financial services and now is a good time to start. With the Biden administration on the way, they can tackle this core issue that, as The Hill says, the U.S. government has "ignored and neglected" the need for a regulatory framework that will support American technological innovation around cryptocurrency, setting aside an embarrassing and "outdated regulatory approach to fintech”. Prof. Lawry suggest a simple and practical response for the US regulators, which is to amend the state-level regulatory frameworks around money services businesses (MSBs), which they say "are the product of a bygone age”, and learn from M-PESA and Alipay where a 100% reserve requirement seems to have proved very successful. There is no evidence that such a requirement stifles growth. Congress need only introduce a uniform requirement that MSB hold a 100% in insured deposits at a bank that holds account balances at the Federal Reserve, which is in essence the same as an EU Electronic Money License and therefore ought to lead to mutual acceptance. In short, China needs tighter regulation of non-bank credit, America needs lighter regulation of non-bank payments. The way forward is to separate the regulation of payments from the regulation of credit from the regulation of investments. This is the way to get competition and innovation in financial services.

~

Are you looking for:

A speaker/moderator for your online or in person event?

Written content or contribution for your publication?

A trusted advisor for your company’s board?

Some comment on the latest digital financial services news/media?