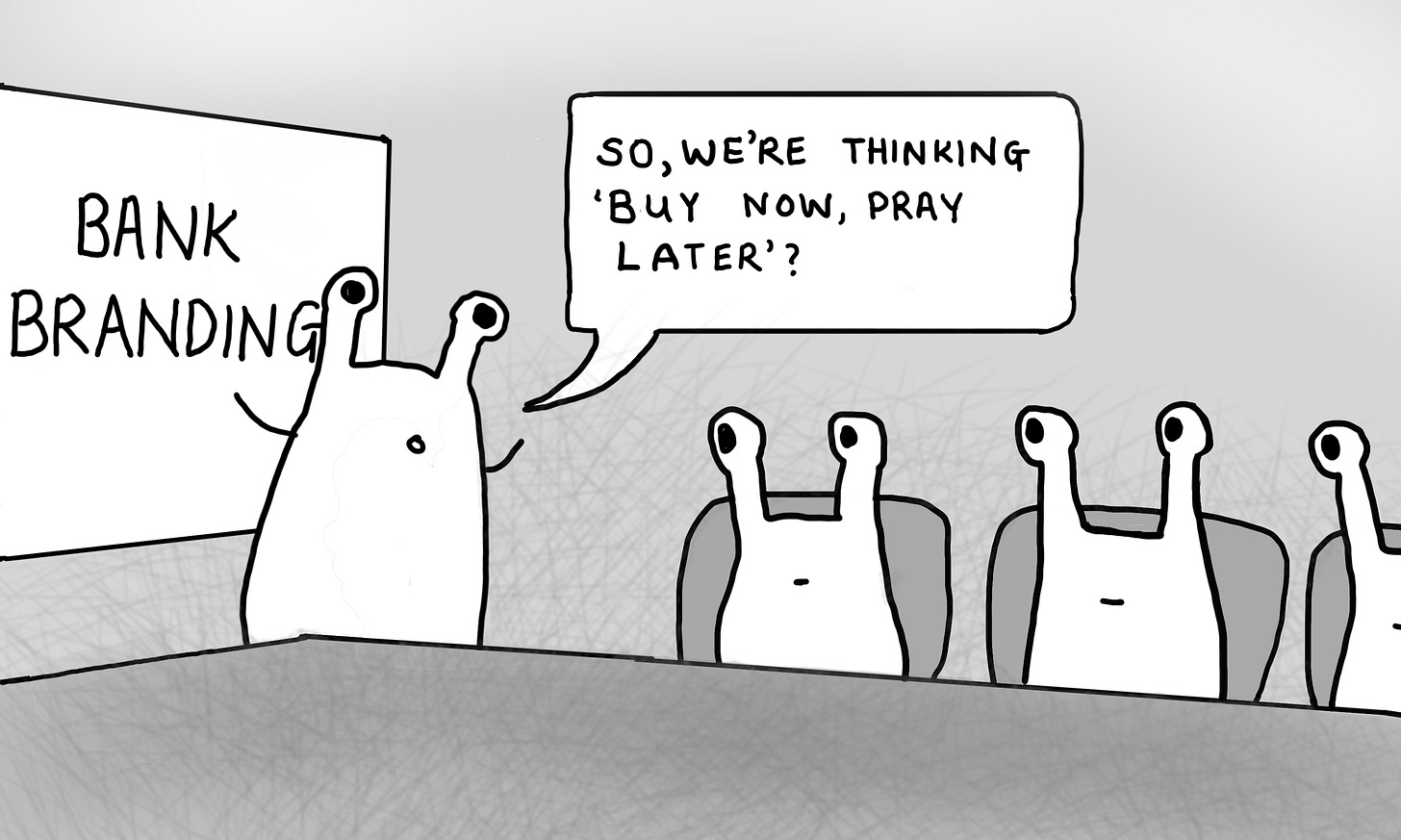

Buy Now, Regulate Later

There nothing inherently wrong with regulation of a fast-growing sector.

Dateline: Woking, 12th October 2023.

The Buy Now Pay Later (BNPL) sector continues to evolve and now the techfins are ramping up the competition. Earlier this year Apple launched its BNPL service in the US to compete for the more than $100 billion in purchases that Americans are making using this payment method (and I don’t doubt that my good friend Ron Shevlin was absolutely right to call it “a winner”) and now Amazon Pay has launched two new BNPL programs to serve different customer segments, ahead of the holiday shopping season. The first allows retailers using Amazon Pay to offer their shoppers the checkout option of Affirm, the second offers convenient spend spreading to Prime Visa and Amazon Visa credit cards. It’s not only fintechs, banks and techfins looking at this sector though: regulators are too.

Meeting a Need

The growth of Buy Now, Pay Later (BNPL) services in many markets has been rapid, and the UK is now different. It is an established option for UK consumers. More than one-third of all Brits have used BNPL services (more than 19 million people), a fraction that has doubled over the last two years.

The main players in the UK market (including Klarna, ClearPay, LayBuy and PayPal as well some of the banks) are clearly providing a service that consumers want and I personally know people who find it a convenient way to manage expenditure. It is currently the fastest-growing online payment method in the UK, with a growth rate double that of bank transfers and more than triple that of digital wallets. When it comes to online purchases, BNPL currently takes up 5% (£6.4 billion) of the UK market and is showing a 200-300% annual growth rate. It is expected to account for 10% of all UK e-commerce spending by 2024. Overall, Research and Markets estimate that the UK BNPL market will grow from around $33 billion per annum now to around $55 billion five years from now. Wow.

with kind permission of Helen Holmes (CC-BY-ND 4.0)

Clearly, BNPL meets a consumer need. But it also delivers for retailers, hence the rapid growth. There are three main reasons for this. First, consumers paying with BNPL were up to three times more likely to purchase after browsing. Secondly, while the most common purchases are clothing and shoes, purchases of electronics, appliances, and other durable goods also raised the average basket size. Finally, there were fewer abandoned transactions (two-thirds of US users said they would abandon a purchase if BNPL wasn’t an option). So consumers like it and retailers like it. So why are there concerns?

Well, I can well remember when BNPL first arrived on our shores, it was used to buy fitness equipments and designer clothes. Now, however, Brits are increasingly reliant on BNPL as a payment method and while there has been a significant shift in spending across all ages, it is young people who are using these the most. And across those age groups, it is no longer about luxuries. Almost two million BNPL customers are now using it for essential items, according to research from the Money and Pensions Service. This includes groceries (11%), toiletries and hygiene (8%), household bills (5%) and fuel (4%). Half of the 10 million BNPL users have a bill they haven’t yet paid off and a third have at least two. Of those with payments outstanding, more than half (55%) owed more than £100. One in seven (14%) owes over £500. More than a third of users spend more than they had planned. BNPL is definitely changing how people pay: Two thirds of Brits say they have used it even though they’d originally intended to pay for the item in full.

(The spectrum of BNPL use is extending. Brits who face long waiting lists for medical treatment and cannot afford to use private doctors instead are being encouraged to sign up for BNPL to cover the costs of basic healthcare.)

Time to Regulate

More than three million UK households owe £2.7bn on BNPL borrowing, according to the Bank of England. This makes me (and many others) wonder whether it is time for some regulation. Indeed, new regulation was planned and BNPL was to be included under the Financial Conduct Authority (FCA) “Consumer Duty”. The FCA found in its latest annual survey that nearly nine million Brits (around a sixth) had used deferred payment credit or BNPL deals in the past year.

So what would regulating look like? Well, for example, it would include the extension of liability under section 75 Consumer Credit Act 1974 (CCA) where purchases have a cash price of more than £100 and less than £30,000 (the “Section 75” provision that was originally introduced to protect credit card users). This may well have made some consumer purchases that are perceived as "high risk" less attractive to fund (e.g., plastic surgery), to the extent they are financed over an extended period with no interest.

However, it appears that the government will hold off for the time being, apparently because some of the bigger BNPL providers said that they could leave the UK market if subjected to "heavy-handed" regulation. Whether this would be a good thing or not I am not qualified to say, although I would observe that given the infrastructure of open banking, machine learning and strong authentication it should not be an overly large burden on commerce to perform “safe to borrow” calculations on prospective BNPL users.

(Note that the Labour Party’s recent conference policy document said that it will “bring forward long overdue consumer protection regulation in areas like buy now pay later” with, I assume, the goal of differentiating from the government over financial services regulation.)

Not Healthy

This delay disappointed consumer campaign groups who have long argued that the sector needs urgent regulation by the FCA. Why? Well, fundamentally, it seems that BNPL consumers do not always consider BNPL credit as debt. This disconnect between BNPL and credit cards could be problematic because of the previously noted increasing trend for young consumers to adopt the use of BNPL products. With BNPL currently unregulated, this means it could be challenging to evaluate an individual’s debt profile/credit rating and also to identify individuals who are struggling to manage multiple credit.

This cuts across the fintech sector’s amazing potential to revolutionise the financial services world by shifting to deliver integrated financial health to consumers (powered by open banking and AI) instead of delivering individual financial services. A regulated BNPL sector is better for everyone.

Are you looking for:

A speaker/moderator for your online or in person event?

Written content or contribution for your publication?

A trusted advisor for your company’s board?

Some comment on the latest digital financial services news/media?

Boring perhaps, but I would agree with David that the time has probably come for some regulation. Not because there is a burning platform that requires urgent intervention, but becasue it is easy it will be necessary rather sooner than later. BNPL has been around now for some years and the rough edges seem to have been polished off voluntarily here and there to the benefit of the consumers. Which is why I would contend that the BNPL industry, even if it is still fast growing, has to grow up from adolescence to maturity. With a clear line of sight for BNPL incumbents and newcomers alike on the do's and don'ts of BNPL, thus creating a competitive level playing field which will ultimately benefit and protect the consumer.